India Follows Trend As Global Trouser Export Market Declines Across The Board In 2023

The 2023 global trouser export market faced significant challenges, with declines across most categories and regions, writes Henry Dsouza, Associate Editor, Textile Insights

In 2023, the global trouser export market experienced a notable downturn, with total exports amounting to US$ 105.35 billion, reflecting an 8.76% decline compared to the previous year. Woven men’s trousers and woven cotton trousers were the most exported categories, representing 24% and 20% of total trouser exports, respectively. Despite their leading positions, both categories witnessed decreases of 6.83% and 7.46%.

Cotton trousers remained the most exported, totaling US$ 60.06 billion, yet they too experienced an 11.27% decline, accounting for 57% of the total trouser exports. Synthetic fibre trousers, the second most exported category, amounted to US$ 34.43 billion, a 5.01% decrease. Trousers made from other textile materials saw an 8.26% drop, totaling US$ 9.27 billion. Notably, woollen trousers, although holding only a 2% market share, were the sole category to experience positive growth, increasing by 11.60% to US$ 1.59 billion.

In gender-specific trends, women’s trousers were the most exported, totaling US$ 54.83 billion, despite an 8.78% decline. They accounted for 52% of total trouser exports. Men’s trousers, representing 48% of total exports, amounted to US$ 50.51 billion, with a decline of 8.74%.

Fibre-specific trends showed that men’s cotton trousers totaled US$ 31.12 billion, a 9.95% decline, while women’s cotton trousers amounted to US$ 28.94 billion, a 12.65% drop. Synthetic fibre trousers totaled US$ 34.43 billion, a 5.01% decline, and trousers made from other textile materials saw 8.26% drop, totaling US$ 9.27 billion.

China led the global market, accounting for 26% of total trouser exports, totaling US$ 27.24 billion, but experienced a 7.51% decline. Bangladesh, the second-largest exporter, saw its exports drop by 20.76% to US$ 15.17 billion. Vietnam, holding the third position, had exports amounting to US$ 8.47 billion, a marginal decline of 0.62%.

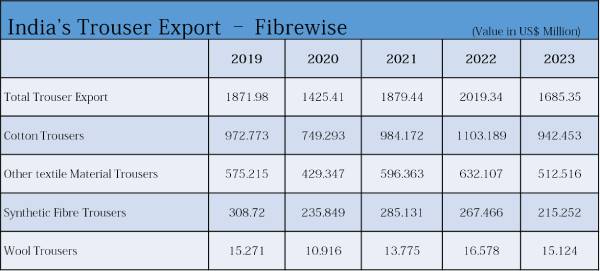

India ranked 15th globally, contributing 2% of the total trouser exports. Cotton trousers were the most exported from India, totaling US$ 942.45 million, a 14.57% decline. Trousers made from other textile materials followed the trend, with exports totaling US$ 512.52 million, an 18.92% drop. Synthetic fibre trousers amounted to US$ 215.25 million, a 19.52% decline. Wool trousers, although less significant, totaled US$ 15.12 million, an 8.77% decline. Gender-wise, men’s trousers held a 57% share of India’s exports, totaling US$ 968.45 million, a 19.80% decline. Women’s trousers accounted for 43%, with exports totaling US$ 716.90 million, an 11.69% decline.

Country-wise, the USA remained the largest market for Indian trousers, accounting for 29% of India’s trouser exports, totaling US$ 496.57 million, a 24.82% decline. The UAE followed, with exports totaling US$ 153.19 million, a 22.16% decline. Positive growth was observed in markets like France (US$ 116.29 million, 2.24% growth), Australia (US$ 34.43 million, 31.95% growth), Yemen (US$ 22.89 million, 3.51% growth), and South Africa (3.55% growth). However, exports to Spain experienced a significant decline, with exports totaling US$ 46.61 million, a 31.41% drop from the previous year, and a 58% decline compared to 2019.

The 2023 global trouser export market faced significant challenges, with declines across most categories and regions. Woven and cotton trousers continued to dominate, but their export figures dropped, reflecting broader economic uncertainties. Synthetic fibre trousers also saw notable declines, while woolen trousers stood out with positive growth. Women’s trousers led in volume despite a downturn, and China and Bangladesh maintained dominant but declining positions.

India’s export performance revealed mixed results, with significant declines and minimal growth in some segments. Key markets like the USA and UAE also experienced notable reductions in import volumes.

This analysis of 2023 trouser export trends highlights the need for industry stakeholders to adapt to changing market conditions, explore new growth opportunities, and develop strategies to navigate the evolving global trade market.