Indian Union Budget 2024: Key Initiatives To Boost Textile, Leather And MSME Sectors

The Indian government has announced several strategic measures in the latest Union Budget, unveiled today by Finance Minister Nirmala Sitharaman. These initiatives aim to enhance the global competitiveness of India’s textile, leather and MSME sectors, which are vital to the country’s economy.

Textile And Leather Sector

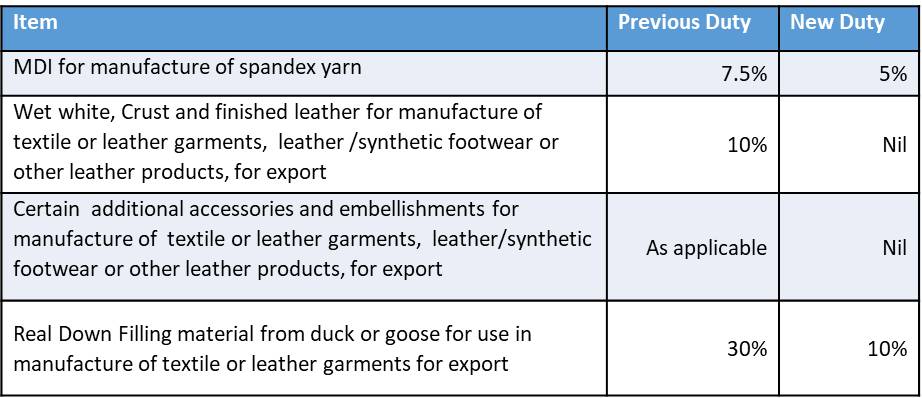

Reduced BCD on MDI for Spandex Yarn: The Basic Customs Duty (BCD) on methylene diphenyl diisocyanate (MDI) for spandex yarn production will be reduced from 7.5% to 5%. This move addresses duty inversion and reduces input costs for manufacturers.

Lower BCD on Down Filling: The BCD on real down filling material from ducks or geese will be lowered from 30% to 10%, making premium filling materials more affordable for garment manufacturers.

Expanded Exemptions: The list of exempted goods for manufacturing textile garments, leather, footwear and other leather articles for export will be expanded, further reducing production costs.

Simplified Export Duties: The export duty structure on raw hides, skins and leather will be simplified and rationalized to streamline export processes.

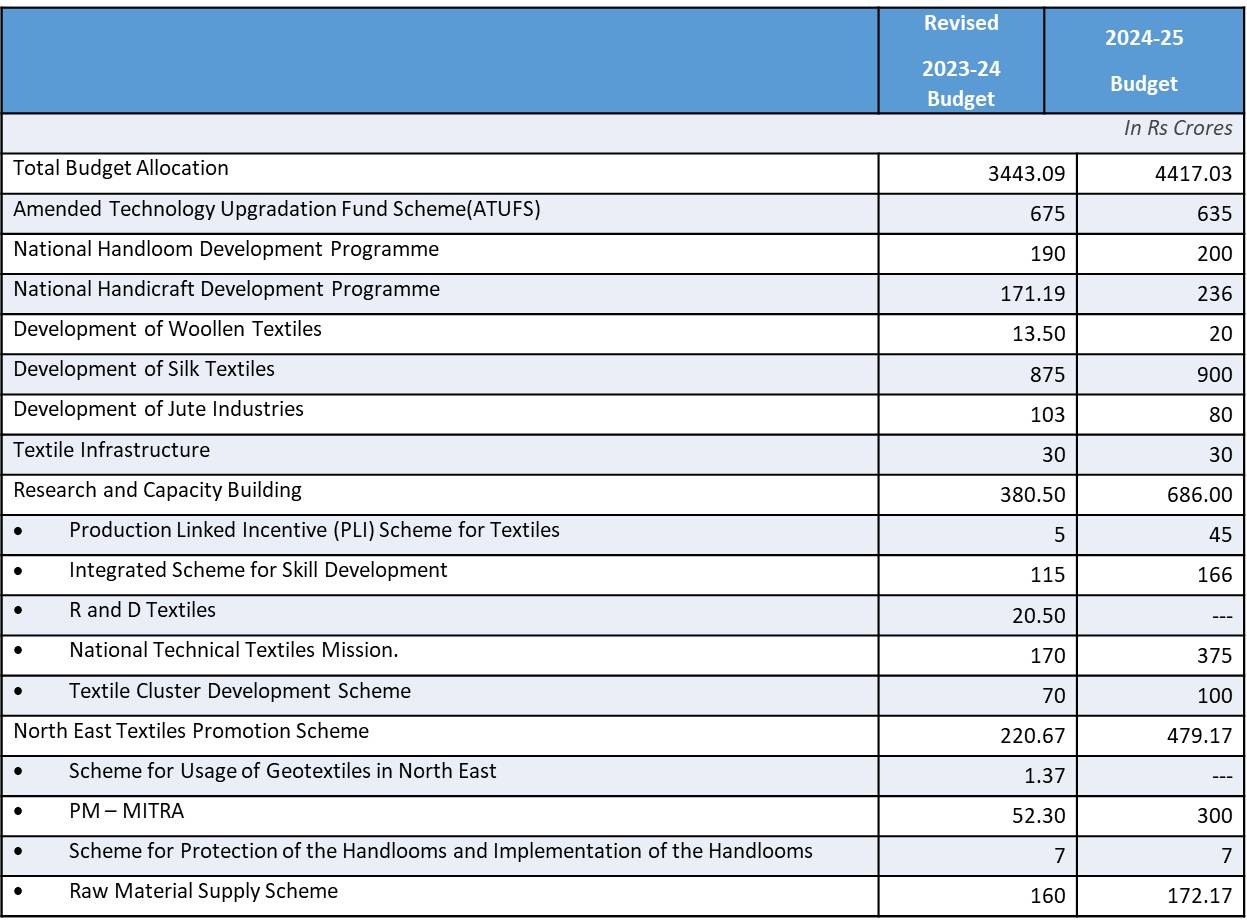

Increased Budget Allocation for Ministry of Textiles for FY2024-25

The Indian government has significantly increased the budget allocation for the Ministry of Textiles for the financial year 2024-25, highlighting its commitment to enhancing the sector’s growth and global competitiveness. The total budget allocation for the Ministry has been raised from Rs 3,443.09 crore in the revised 2023-24 budget to Rs 4,417.03 crore in the 2024-25 budget.

Transforming Agriculture Research

The government will undertake a comprehensive review of the agriculture research setup to bring the focus on raising productivity and developing climate resilient varieties. Funding will be provided in challenge mode, including to the private sector. Domain experts both from the government and outside will oversee the conduct of such research.

Release of new varieties

New 109 high-yielding and climate-resilient varieties of 32 field and horticulture crops will be released for cultivation by farmers.

Natural Farming

In the next two years, 1 crore farmers across the country will be initiated into natural farming supported by certification and branding. Implementation will be through scientific institutions and willing gram panchayats. 10,000 need-based bio-input resource centres will be established.

Buoyed by the success of the pilot project, the government, in partnership with the states, will facilitate the implementation of the Digital Public Infrastructure (DPI) in agriculture for coverage of farmers and their lands in 3 years. During this year, digital crop survey for Kharif using the DPI will be taken up in 400 districts. The details of 6 crore farmers and their lands will be brought into the farmer and land registries. Further, the issuance of Jan Samarth based Kisan Credit Cards will be enabled in 5 states.

SUPPORT FOR MSMEs

The budget includes a comprehensive support package for micro, small and medium enterprises (MSMEs), focusing on financing, regulatory changes and technology support.

Credit Guarantee Scheme: A new scheme will provide term loans for machinery and equipment purchases without collateral, offering up to Rs 100 crore in guarantee cover, with borrowers paying upfront and annual fees.

New Credit Assessment Model: Public sector banks will develop in-house capabilities to assess MSME credit based on digital footprints, improving access to credit for MSMEs without formal accounting systems.

Credit Support During Stress: A new mechanism will ensure continued bank credit for MSMEs during stress periods, supported by a government-promoted fund guarantee to prevent NPAs.

Enhanced Mudra Loans: The Mudra loan limit under the ‘Tarun’ category will increase from Rs 10 lakh to Rs 20 lakh for entrepreneurs who have repaid previous loans.

Expanded TReDS Onboarding: The turnover threshold for mandatory onboarding on the TReDS platform will reduce from Rs 500 crore to Rs 250 crore, adding 22 CPSEs and 7,000 companies, including medium enterprises.

SIDBI Branch Expansion: SIDBI will open 24 new branches this year, expanding to 168 out of 242 major MSME clusters within three years.

E-Commerce Export Hubs: E-Commerce Export Hubs will be established in PPP mode to help MSMEs and artisans sell products internationally, offering trade and export services under one roof.

Employment Linked Incentive

The government will implement following 3 schemes for ‘Employment Linked Incentive’, as part of the Prime Minister’s package. These will be based on enrolment in the EPFO, and focus on recognition of first-time employees, and support to employees and employers.

Scheme A: First Timers

This scheme will provide one-month wage to all persons newly entering the workforce in all formal sectors. The direct benefit transfer of one-month salary in 3 instalments to first-time employees, as registered in the EPFO, will be up to Rs 15,000. The eligibility limit will be a salary of Rs 1 lakh per month. The scheme is expected to benefit 210 lakh youth.

Scheme B: Job Creation in manufacturing

This scheme will incentivize additional employment in the manufacturing sector, linked to the employment of first-time employees. An incentive will be provided at specified scale directly both to the employee and the employer with respect to their EPFO contribution in the first 4 years of employment. The scheme is expected to benefit 30 lakh youth entering employment, and their employers.

Scheme C: Support to employers

This employer-focussed scheme will cover additional employment in all sectors. All additional employment within a salary of Rs 1 lakh per month will be counted. The government will reimburse to employers up to Rs 3,000 per month for 2 years towards their EPFO contribution for each additional employee. The scheme is expected to incentivize additional employment of 50 lakh persons.

Participation of women in the workforce

The government will facilitate higher participation of women in the workforce through setting up of working women hostels in collaboration with industry, and establishing creches. In addition, the partnership will seek to organize women-specific skilling programmes, and promotion of market access for women SHG enterprises.

Skilling programme

The FM announced a new centrally sponsored scheme, as the 4th scheme under the Prime Minister’s package, for skilling in collaboration with state governments and Industry. 20 lakh youth will be skilled over a 5-year period. 1,000 Industrial Training Institutes will be upgraded in hub and spoke arrangements with outcome orientation. Course content and design will be aligned to the skill needs of industry, and new courses will be introduced for emerging needs.

DIRECT TAX REFORMS

The budget introduces significant changes in the direct tax regime to reduce compliance burdens and provide tax relief.

Tax Simplification with the New Tax Regime:

- Standard deduction for salaried employees increased from Rs 50,000 to Rs 75,000.

- Deduction on family pension increased from Rs 15,000 to Rs 25,000.

- Taxpayer savings up to Rs 17,500.

- New tax rates:

- 0-3 lakh rupees Nil

- 3-7 lakh rupees 5 per cent

- 7-10 lakh rupees 10 per cent

- 10-12 lakh rupees 15 per cent

- 12-15 lakh rupees 20 per cent

- Above 15 lakh rupees 30 per cent

Capital Gains Tax:

- Short-term gains on financial assets taxed at 20%.

- Long-term gains on all assets taxed at 12.5%.

- Exemption limit for capital gains on financial assets increased to Rs 1.25 lakh per year.

Corporate Tax: Corporate tax rate on foreign companies reduced from 40% to 35%.

Special Initiatives:

- Abolition of angel tax for all classes of investors.

- Simpler tax regime for domestic cruise operations.

- Safe harbour rates for foreign mining companies selling raw diamonds.

These measures collectively aim to foster growth and competitiveness in key sectors, supporting India’s economic development and global trade ambitions.

Industry’s Reaction To The Union Budget 2024-25

Riju Jhunjhunwala, CMD RSWM Ltd & MD Bhilwara Energy Ltd

“The Union Budget 2024 presents a holistic approach to India’s economic growth, with a strong emphasis on manufacturing, energy, and sustainability. The employment incentives for the manufacturing sector are poised to stimulate job creation and strengthen our workforce. The focus on nuclear energy development and indigenous thermal power technologies demonstrates a commitment to energy security and efficiency. The budget’s sustainability measures, particularly the rooftop solar scheme, are set to transform energy consumption at both household and industrial levels. Overall, this budget lays a solid foundation for industrial growth, aligning with our vision of a sustainable and innovative future for India.”

N. Chandran, Chairman, Eastman Exports

“The budget priorities such as employment and skilling, social justice, and manufacturing are a step in the right direction in pursuit of Viksit Bharat 2047. The government has rightly renewed its focus on four major pillars: the poor, women, youth, and farmers.

I genuinely think the budget holds great promise in addressing the labor and skill shortages, which are crucial for labor-intensive sectors like textiles. Additionally, the announcement of a ₹3 lakh crore corpus for women-centric schemes will increase their participation in the workforce. The plans to set up hostels and establish crèche facilities are key initiatives to encourage unskilled and semi-skilled women to remain in the workforce, thus fostering a more inclusive and productive economy.”

Rahul Mehta, Chief Mentor, Clothing Manufacturers Association of India (CMAI)

“This budget is extremely pragmatic and innovative in some of the bold decisions and directions it has taken to encourage employment directly. The steps include an internship scheme, the decision to reimburse one month’s wages for new employees, and subsidies for employees earning over a lakh of rupees. These are excellent steps being taken. However, there are many open-ended areas at this point, and we await the details before making specific suggestions. Nonetheless, this is a visionary, pragmatic, and very innovative budget that the Finance Minister has presented. While most of these measures are for all industries, they will likely benefit the textile and apparel industry equally, if not more, since it is more labour-oriented. Therefore, we are confident it will benefit the apparel industry.

Furthermore, the additional measures announced to support bank credits to MSMEs and the easing of foreign investment will also benefit the textile and apparel industry. The import relaxation on some of the important raw materials, trims, and accessories required for garment manufacturing will also help garment manufacturers to be more competitive, especially in the export markets.”

Kumar Rajagopalan, CEO, Retailers Association of India (RAI)

“The government has balanced populist and policy measures well. RAI appreciates the focus on empowering the middle class and rural population. Initiatives like monetary support for farmers, higher personal income tax exemptions, and increased standard deductions will boost disposable income and stimulate spending, driving economic growth. The reduction of duty on gold, precious metals, and mobile phones will benefit these sectors, especially during festive seasons.

The commitment to skilling and employment support, including youth programs, ensures a future-ready workforce for the retail sector. Emphasis on MSMEs and startups, enabling more lending and abolishing angel tax, is a positive step. The Employment Linked Incentive, reimbursing employers up to ₹3,000 per month for EPFO contributions, is also welcome.

Supporting working women through hostels and crèches and focusing on urban shopping infrastructure development are significant steps forward.”