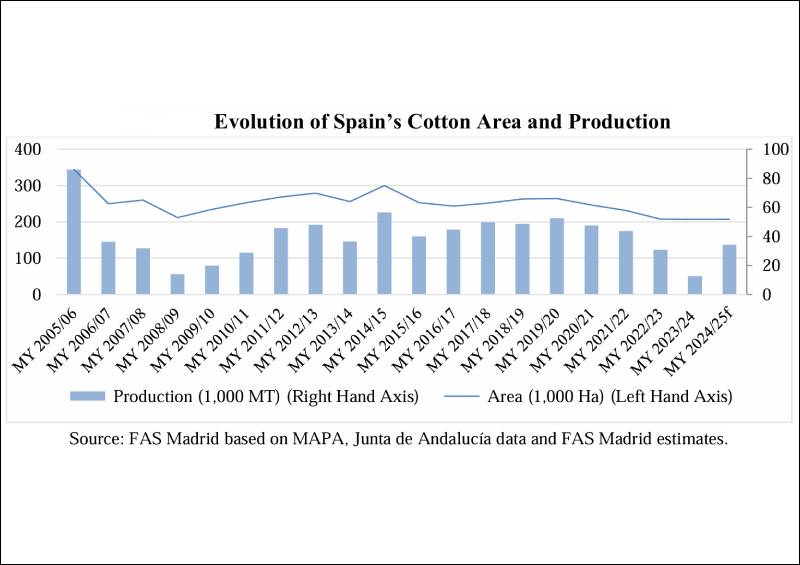

Spain’s Cotton Area and Production Outlook For MY 2024/25

Spain’s cotton area for MY 2024/25 is projected to decline slightly from MY 2023/24, covering just over 51,000 hectares. Although much-needed rains arrived, they were too late to influence expansion plans, as farmers had already set their planting schedules. Majority of cotton in Spain is planted in April. While early planting began in late March 2024, rainfall delayed the process, with most planting eventually occurring in the latter half of April. Cooler-than-average spring temperatures also delayed cotton crop emergence and early growth.

Spring rains, however, replenished water reservoirs in the Guadalquivir basin, ensuring sufficient irrigation resources. Additionally, the rains improved soil moisture levels for the crop’s initial development stages, delaying irrigation needs. In some cases, excessive water led to replanting.

The crop’s phytosanitary condition has been largely satisfactory, with minimal pest presence, including Agriotes sp., Agrotis sp., Rhizoctonia solani, Aphis gossypii, and Tetranychus urticae, affecting only a few plots late in the growing season.

Official estimates suggest that raw cotton production in Andalucia, where nearly all of Spain’s cotton is grown, may exceed 137,000 metric tonnes in MY 2024/25. This marks a notable recovery after the drought-affected MY 2023/24.

Consumption and Trade

Exports continue to be the main outlet for Spain’s cotton lint production, accounting for 94% of the country’s cotton fibre output on an average. However, the reduced crop in MY 2023/24 limited export potential. Key export destinations included other EU member states, Bangladesh, Pakistan and Morocco. With the projected production recovery in MY 2024/25, exports are expected to return to normal levels.

Following a peak in MY 2020/21 due to increased demand for sanitary apparel, Spain’s cotton lint imports have been on a downward trend. Imports remained stable in MY 2023/24 despite a poor domestic harvest, with Turkey, India and Argentina being the main suppliers outside the EU.