VF Corp Q3 Revenues Slip 16%. Plans Brand Portfolio Review

While announcing financial results for the third quarter ending December 30, 2023, VF Corporation said it will explore strategic review of its brand assets.

The fashion retailer, which owns iconic brands like Vans, The North Face and Timberland reported a 16 percent year on year decline in revenue to $3.0 billion in the third quarter.

VP Corp also said that it will also do a strategic portfolio review, under which it has initiated an in-depth strategic review of the brand assets within the portfolio.

“This is to ensure the company owns the brands that it believes create the greatest long-term value,” the company said in a press release.

According to the company, the quarter was negatively impacted by a shift in timing of wholesale deliveries, which was most pronounced for the North Face and the EMEA region.

VF Corp reported a loss per share at $0.11 in the quarter under review compared to earnings per share of $1.31 in the similar quarter of last year.

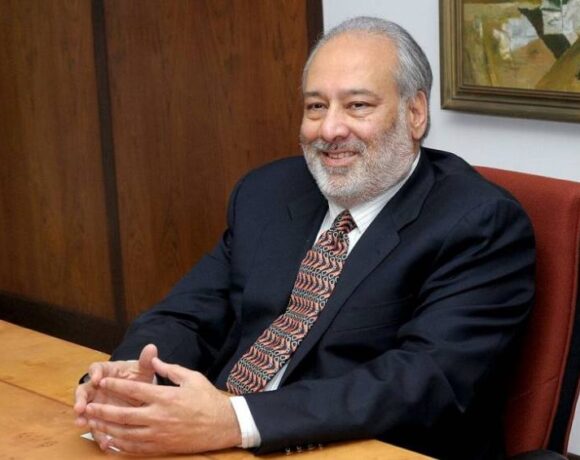

“Our third quarter top-line performance was disappointing,” Bracken Darrell, President and CEO at VF Corp said.

“However, we are confident the actions we are implementing as part of Reinvent will enable VF to stabilise and grow revenue and improve operational performance across brands and regions,” he added.

“We have already begun to see the impact to right-size the company’s cost structure and improve its inventory position, resulting in stronger than expected cash flow and expanded gross margin,” Darrell stated.

During the quarter, the company continued to execute the Reinvent transformation program, which aims to enhance focus on brand-building and to improve operating performance.

The initial four priorities of Reinvent are to improve North America results, deliver the Vans turnaround, reduce costs and strengthen the balance sheet.

The company will continue to pursue opportunities to simplify and streamline its processes and invest in the business to drive brand heat and accelerate a return to growth.