CRISIL Ratings: Home Textiles Industry To Grow 6-8% This Fiscal

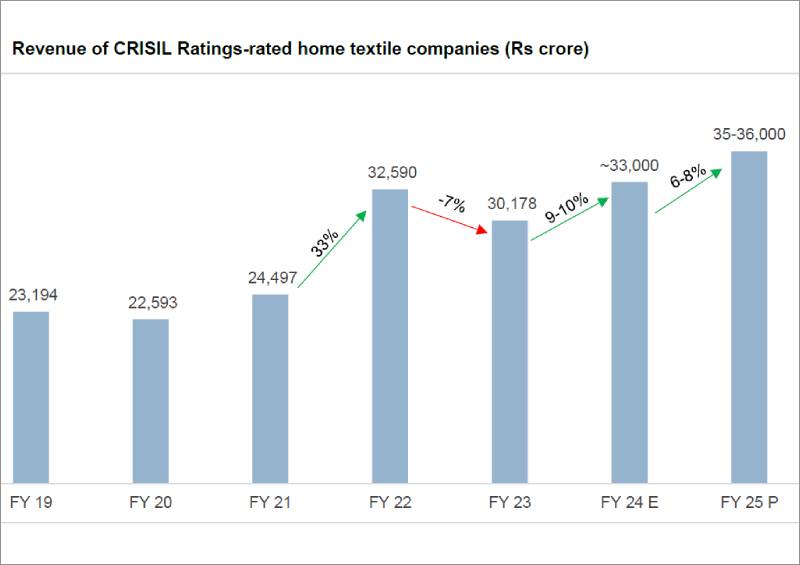

India’s home textile industry is projected to achieve 6-8% growth this fiscal year following a 9-10% revenue rebound last fiscal. This growth will be driven by resilient demand from the US, the industry’s primary export market, and expansion in the domestic market, despite ongoing logistical challenges.

A CRISIL Ratings analysis of 40 companies, representing 40-45% of the industry’s revenue, indicates that the credit profiles of home textile companies will remain stable. This is supported by healthy cash accruals and moderate capital expenditure (capex) plans, bolstered by deleveraged balance sheets.

The home textile sector derives 70-75% of its revenue from exports, with the US accounting for 60%, and the remainder from the domestic market.

Mohit Makhija, Senior Director at CRISIL Ratings, explains that three key factors will drive growth this fiscal: resilient consumer spending in the US, normalized inventory levels at major retailers, and continued domestic expansion. Additionally, domestic cotton prices are expected to remain competitive, closely tracking international prices, ensuring India’s exports maintain their share in US imports, which stood at around 30% in January-August 2024, similar to 2023 levels.

While international cotton prices fell below domestic prices from June to September 2024 due to an increase in cotton supply from Brazil and the US, the start of India’s cotton season is expected to close the gap, helping to maintain export competitiveness.

Operating margins for the industry are expected to remain stable at 14-15% this fiscal, insulated from recent freight cost fluctuations as most exports are on a free-on-board basis.

Over the past five years, the industry has invested approximately Rs 8,500 crore in capacity expansion, with capacity utilization expected to stay at 60-70% this fiscal. Although many companies will focus on optimizing existing capacity, a few large players will continue investing, supported by their deleveraged balance sheets.

Pranav Shandil, Associate Director at CRISIL Ratings, notes that steady operating performance and moderate capex in fiscal 2025 should keep the interest coverage ratio stable at 5-6 times (compared to 5.5 times last fiscal). Healthy cash accruals are likely to reduce the need for external debt, keeping the total outside liabilities to tangible net worth ratio low, at 0.6-0.7 times this fiscal (down from 0.7 times last fiscal).

However, potential risks include a slowdown in the US market or a surge in domestic cotton prices compared to international prices, both of which will be closely monitored.