Japan – The High Potential Market for India’s Apparel Manufacturers

Japan, the island country located in East Asia, is the eleventh most populated and urbanized country with a population of more than 125 million. GDP-wise, Japan is the third largest economy after the United States and China and eighth largest labour force with over 68.6 million workers.

Japan is the fourth largest textile and apparel importer of the world, even though the population of the nation is small when compared with other main global markets.

According to UN Comtrade statistics, Japan Textile & Apparels (T&A) imports from the world totaled US$ 34973.32 million in 2022 and witnessed a growth of 4.82% over the previous year.

China, Vietnam, Bangladesh, Indonesia and Cambodia are the top five T&A suppliers to Japan, accounting for 81% share of Japan’s total T&A imports.

China dominates the Japanese T&A market with 56% share with an import value of US$ 19462.55 million. After China comes Vietnam with 14% share. Bangladesh, Indonesia and Cambodia are competing with each other with shares of 4%, 4% and 3%, respectively.

Product-wise, apparel is the dominating commodity in Japan’s T&A imports basket, with a share of 71% of the total T&C imports. The knitted apparel imports totalled US$ 12957.46 million with a growth of 3.4% in 2022 over the previous year, while woven apparels totalled US$ 12009 million registering a growth of 6.1%. Both knitted and woven are moving neck-to-neck, with shares of 37% and 34%, respectively, of the total T&A imports of Japan.

This is followed by other made-up textiles, non-woven, man-made textile (MMF), carpet and cotton, with shares of 14%, 4%, 3%, 2% and 2%, respectively. Amongst all these products, cotton imports have witnessed the highest growth of 22.08% to US$ 606.62 million in 2022 over the previous year.

Japan’s T&A imports from China, which witnessed a minimal change of 0.41% in 2022, were worth US$ 19462.55 million. Apparels imports dropped marginally by 0.65% to US$ 13811.41 million.

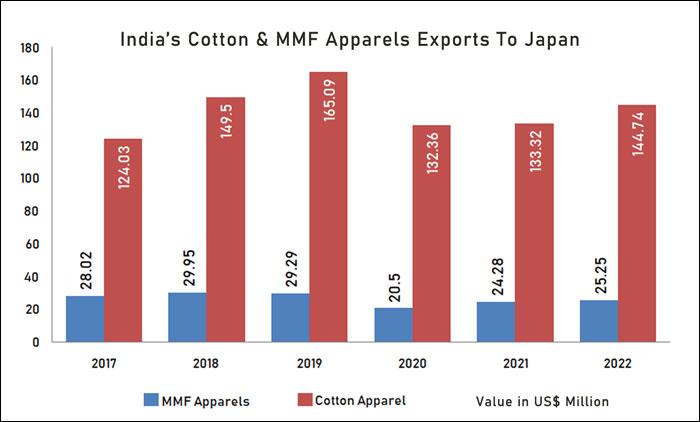

India is the ninth largest T&A supplier to Japan. India’s T&A exports to Japan totalled US$ 386.06 million, registering a growth of 5.63% in 2022 over the previous year. Apparel is the major commodity with 51% share, followed by cotton, other made-ups textile and carpets with shares of 17%, 14% and 4%, respectively.

In the apparel segment, the major products exported from India to Japan are cotton blouses, cotton dresses, cotton T-shirts, cotton furnishing articles and cotton trousers. Indian apparel manufacturers and exporters have a huge market in Japan, but due lack of quality culture, India is missing out on big opportunities in Japan market.

Indian manufacturers have only mastered the skill of selling cotton-based apparels, but the same is not true for MMF-based apparels. To fill this gap, Indian government introduced the Production Linked Incentive (PLI) scheme. The scheme will give a major push to increase production and exports of MMF apparels from India. Therefore, a huge potential market awaits Indian apparel manufacturers in the form of MMF apparels.

AEPC organized two-day Reverse Buyer Seller meet under the name of ‘UPNEXT INDIA 2023’ which kick-started with Japan. 84 prominent Japanese buyers, including trading companies and retail chains/stores, are in India to source their requirements from the 112-odd Indian exhibitors who displayed diverse range of RMG reflecting Japanese taste.

Naren Goenka, Chairman, AEPC, said, “We have a strong business opportunity in Japan, which is reflected by the fact that China, which has been a dominant garment supplier to Japan, has witnessed a decline in the past 5 years, giving significant advantage to India. The garment industry in both the countries have geared up to increase this trade taking advantage of duty-free access for Indian RMG post Indo-Japan CEPA agreement, as against an approximate 9% duty for China and Turkey.”

Goenka further said, “The government is coming up with a PLI scheme which will majorly include Ready Made Garment (RMG). This PLI will be with much simpler norms to be eligible, which will largely address the issue of capacity creation and fabric diversification. Additionally, the government has issued BIS standards for importers and exporters to ensure stable and safe quality. Plus, on the higher freight cost, the government is considering enabling vessels to sail directly to Japan so that the time and cost gets reduced drastically.”

All the above measures are expected to benefit T&A exporters, providing a boost to T&A exports from India to Japan.