India’s T&A Exports Witness Major Decline

Cotton textiles exports have dropped drastically, negatively affecting the overall T&A exports from India

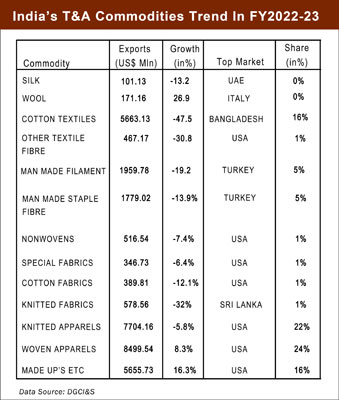

India’s textile and apparel (T&A) sector witnessed a major drop of 17.9% in FY2022-23. The exports earnings in the same year totalled US$ 35666.78 million, while in FY2021-22, the earnings were US$ 43437.50 million. The sector contributes 8% to country’s total exports in FY2022-23, while its contribution was 10% in the previous year.

The decline in the T&A exports is the result of high cotton prices, high inventories with international buyers, sluggish market and Russia-Ukraine war.

The top markets for India’s T&A goods are USA, Bangladesh, UAE, UK and Germany. USA remains the largest market for India’s T&A. Commodity-wise, woven apparel is now the largest exported commodity.

All commodities, except wool and woven apparels, have witnessed decline in the export market. Woven apparel, which is the largest exported commodity, has surpassed cotton textiles and knitted apparels exports in FY2022-23.

India’s cotton textiles exports drops nearly by half

India’s cotton textiles exports drops nearly by half

India’s cotton textiles exports fell by 47.5% to US$ 5663.13 million in FY2022-23. Bangladesh remains the largest buyer for Indian cotton, with total exports of US$ 2028.85 million, but exports declined by 55.5% in FY2022-23.

Under this segment, cotton yarn is the highest exported product, with exports of US$ 2752.56 million, a decline of 49.9% in value terms. However, in terms of quantity exported, the fall was quite drastic. Indian manufacturers exported around 484.04 million kgs of cotton yarn in FY2022-23, as compared to exports of 1386.95 million kgs in the previous fiscal.

Similarly, Indian raw cotton has recorded a steep decline of 71.9% in exports totalling US$ 749.33 million in FY2022-23. Around 231.05 million kgs of raw cotton, including cotton waste and cotton thread, was exported by India.

Knitwear exports down by 5.8%

Knitwear apparel exports have declined by 5.8% in the international market. The commodity’s export value totalled US$ 7704.16 million in FY2022-23. USA remains the largest market for India’s knitwear apparels. Knitwear exports to the top four major markets have witnessed a decline.

T-shirt, which remains the most exported product under knitwear, has declined by 3%, with a total export of US$ 2393.40 million in FY2022-23. Under the T-shirt segment, cotton T-shirt exports totalled US$ 1771.93 million, while T-shirt made of other textile materials totalled US$ 621.47million.

Exports of men’s shirt went up by 14.38% to US$ 740.06 million, while men’s brief, underpants and nightwear exports fell by 13.2% to US$ 625.54 million in FY2022-23 compared to the previous fiscal.

Woven apparel: Top and trending commodity

Woven apparel is one of the two commodities that witnessed a positive growth in the segment. Exports of this commodity totalled US$ 8499.54, with growth of 8.3% in FY2022-23 over the previous year.

Here too, USA remains the largest market, with a growth of 11.3% at US$ 2927.16 million in FY2022-23. Exports to U.A.E registered a drop of 41.8%, while Spain and UK witnessed a substantial growth of 22.4% and 20.34%, respectively.

Dresses made of cotton were exported the most under this segment, with their exports totalling US$ 885.12 million, registering a growth of 23%.The second topmost were dresses made of synthetic fibre at US$ 729.09 million, recording a growth of 20.2% in FY2022-23.

Other textile made-ups exports fall

The exports of other textile made-ups fell by 16.3% to US$ 5655.73 million in FY 2022-23. Kitchen and toilet linen were the top products under this category, with their exports growing by 7% to US$ 1023.55 million in FY2022-23.

Here too USA is the main market, with exports totalling US$ 2618.76 million, down by 24.21% in FY2022-23. USA accounts for 46% share of the total exports of other textile made-ups from India. Rest of the export markets too have recorded negative growth in other textile made-ups, but their share in this segment is very small.

Italy surpasses UK in wool exports

Wool has witnessed highest growth of 27% over the previous year in T&A export basket. Exports of wool totalled US$ 171.16 million in FY2022-23.

Italy has overtaken UK in wool exports from India. Exports to Italy totalled US$ 39.5 million, a growth of 85.5% in FY2022-23 and accounting for 23% share of the total wool exports from India. Even UK too recorded a growth of 26.1% at US$ 30.76 million for the same fiscal year.

Under the wool segment, the yarn of combed wool is the most exported item, with exports of US$ 109.52 million, a growth of 43.35% in FY2022-23.

MMF & MMSF Exports Down

The exports of both Man Made Filament (MMF) and Man Made Staple Fibre (MMSF) declined by 19.2% and 13.9% respectively in FY2022-23 as compared to the previous year.

Under MMF, high tenacity yarn of nylon, which was the topmost product in the previous fiscal, registered a drop of 35.6% in FY2022-23 to US$ 913.96 million.

Under MMF commodity, woven fabric of synthetic filament yarn was the top product. The export of this product totalled US$ 936.51 million and witnessed a rise of 4.22% in FY2022-23. The product accounts for48% of the total MMF exports from India.

Under the MMSF commodity, other woven fabrics of synthetic staple fibres were exported the most in FY2022-23. The exports of this product totalled US$ 407.74 million, a growth of 14.56%.

Country-wise India’s T&A export trends

As the buying from almost all the countries remained lower than expected, the top markets have witnessed a negative trend in FY2022-23.

Huge drop in exports to China

Huge drop in exports to China

China was the fifth largest market for India’s T&A goods in FY2021-22, but in the last fiscal, the country stood on 15th position. Exports to such a major market dropped by 70% to US$ 4823.79 million in FY2022-23. China now accounts for 1% of the country’s total T&A exports, while in FY2021-22, it accounted for 4%.

India largely exports cotton to China. In FY2022-23, the cotton exports to China totalled US$ 245.96 million, with a drop of 80.4% over the previous fiscal.

USA – The unbeatable market for India’s T&A goods

USA has always been the largest and unbeatable market for India’s T&A goods. In FY2022-23, T&A exports to the US totalled US$ 10085.32 million, a decline of 11.4%.

Apparel is the largest exported commodity to the US. The overall apparel exports totalled US$ 5411.18 million, a growth of 1.28% in FY2022-23 over the previous year. Apparel accounts for 54% of country’s total T&A exports to the US.

Other made-ups of textile commodity dropped by 24.21% to US$ 2618.76 million and exports of carpets and other textile floor coverings declined by 17.8% to US$ 1058.69 million in FY2022-23.

Exports to Bangladesh significantly down, cotton on negative trend

Bangladesh is now the second largest export market for India’s T&A goods. India’s T&A exports to Bangladesh registered a negative growth of 51.1% to US$ 2532.03 million in FY2022-23 over the previous year.

Cotton is the chief commodity exported to Bangladesh and constitutes 80% share of total T&A exports to Bangladesh. Cotton exports to Bangladesh fell by 55.5% to US$ 2028.85 million in FY2022-23 over the previous year.

UAE and UK share 6% each

The exports to UAE declined by 21.6% to US$ 2056.55 million. Apparel is the major commodity exported to UAE and its exports totalled US$ 1228.35 million, a fall of 32.6% in FY2022-23.

Exports to UK totalled US$ 1999.05 million, a slight fall of 1.6% in FY2022-23. The Indian apparel goods are dominating the UK market, with exports totalling US$ 1470.21 million, a growth of 5.52% in FY2022-23.

Turkey major market for India’s MMF and MMSF

Turkey is the topmost market for India’s man-made filament and man-made staple fibre with value of US$ 307.29 million and US$ 238.57 million, respectively. Both the commodities have registered a drop of 16.6% and 14.6%, respectively. The total T&A exports to Turkey from India totalled US$ 715.81 million. However, the exports registered a drop of 21.7% in FY2022-23 over the previous year.