ITMF: High Costs And Weak Demand Continue To Challenge Textile Industry

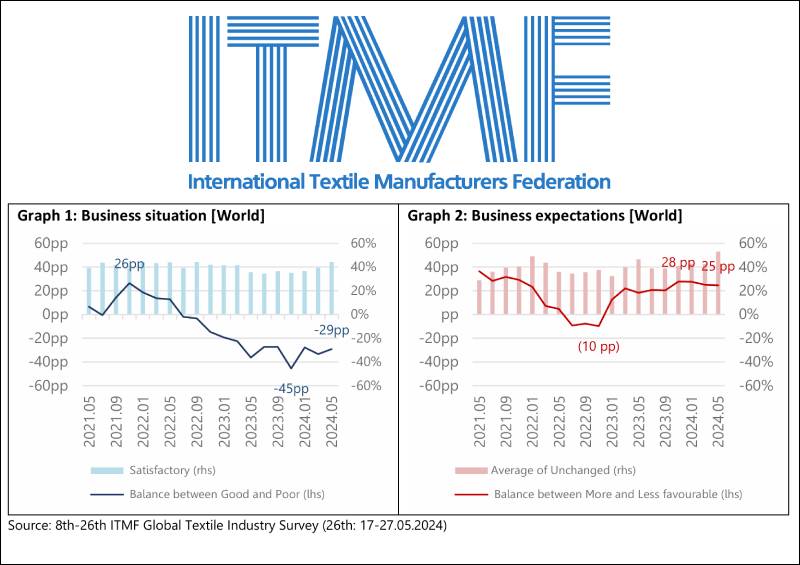

The International Textile Manufacturers Federation (ITMF) has released the findings of the 26th Global Textile Industry Survey (GTIS), conducted in May 2024. The results indicate a persistent stagnation in the textile business climate, despite a marginal improvement in the economic situation as more companies rate their business as “satisfactory.” However, this positive sentiment reflects optimism rather than actual improvement, as the entire supply chain continues to grapple with a lack of orders and high costs that negatively impact profit margins.

The balance between “good” and “poor” order intake has shown slight improvement, and expectations for order intake over the next six months are trending upwards. Since the summer of 2023, the order backlog has fluctuated around an average of two months, rising modestly from 1.9 months in March 2024 to 2.1 months in May. Despite this increase, it is too early to interpret this as a definitive positive trend.

The average capacity utilization rate saw a marginal rise to 71% in May 2024, up from its decline following a peak of 80% at the end of 2021. Survey participants anticipate better capacity utilization rates in the coming six months.

Key Findings

Business Situation: The economic climate remains stagnant, with minor improvements in perceived business satisfaction. Optimism persists, yet the reality of high costs and low order volumes continues to weigh heavily on the industry.

Order Intake and Backlog: Slight improvements in order intake and backlog were observed. The order backlog increased from 1.9 months in March 2024 to 2.1 months in May 2024, signaling potential future stability.

Capacity Utilization: The average capacity utilization rate increased slightly to 71% in May 2024, with expectations of further improvement over the next six months.

Inventory Levels: 59% of companies reported average inventory levels, with North America showing the highest levels among regions, and spinners among segments. Inventories at brands and retailers remain high but are gradually decreasing.

Regional and Segment Variations: Africa and Europe reported relatively low order cancellations, while the Americas experienced higher levels, particularly among spinners and finishers/dyers/printers.

Main Concerns

Weak Demand: Weak demand remains the primary concern since September 2022, although its significance has decreased over the past six months.

High Costs and Geopolitics: High raw material prices, geopolitical issues, high energy prices, and a shortage of workers and talents are other major concerns.

Despite these challenges, the industry shows signs of cautious optimism. The slight upward trends in order intake and capacity utilization, coupled with decreasing inventories at brands and retailers, hint at potential stabilization. However, the prolonged negative business cycle continues to compel companies to produce at a loss or with lower capacity utilization, with no significant change expected throughout 2024.